....plus c'est la même chose

"Hat-Tip" is written by Nick Lincoln, IFA

You could be forgiven for thinking we are living in unprecedented, tumultuous times. With yesterday's announcement of yet another General Election, it's not hard to discern a sense of fatigue, combined with a general mood of pervasive uncertainty.

This is understandable. After all, in recent times we have had a series of events that would ordinarily appear to be extraordinary.

In no particular order we have:

In the USA, a Republican President, who may well be impeached, seen by many as the Devil Incarnate, and generally far too chummy with Russia.

Escalating political tensions in Northern Ireland and Eire.

The return of some form of inflation, together with stagnant wages.

A series of exhausting political events (General Elections, referenda etc).

Wars and tensions in the Middle East.

Reach for the flares - but hold the Austin Allegro

Given the above, it's easy to think that we have reached a Perfect Storm of uncertainty. Of dangers both known and unknown. And yet....

Let's step into our mental Time Machine and take a short journey back through the decades. Let's stop off at the early-to-mid 1970s. We open our eyes and what do we see?

In the USA, a Republican President, who may well be impeached, seen by many as the Devil Incarnate, and generally far too chummy with Russia. His name was Richard Nixon, not Donald Trump. Nixon made Trump look the very model of inner peace and tranquility.

Escalating political tensions in Northern Ireland and Eire. The "Troubles" that started in the late 1960's had very quickly gone very, very nasty by the mid-1970s.

The return of some form of inflation, together with stagnant wages. Quite. In 1975 - albeit briefly - inflation touched 25%! We also had "stagflation": surging prices and surging unemployment.

A series of exhausting political events (General Elections, referenda etc). In 1974, Edward Heath called two (!) General Elections, asking who governed the UK, him or the Unions? The "answer" was Harold Wilson (eg the Unions). Then, in 1975, we had a referendum on whether or not we were to remain in The Common Market, as the European political union project was then named.

Wars and tensions in the Middle East. It's no picnic now. But in the early 1970s, following The Six Day War and its sequel (The Yom Kippur War) the Middle East was pretty desperate. Let's not forget the 1973 OPEC oil embargo, for added misery.

Uncertainty is here. Get used to it. Embrace it

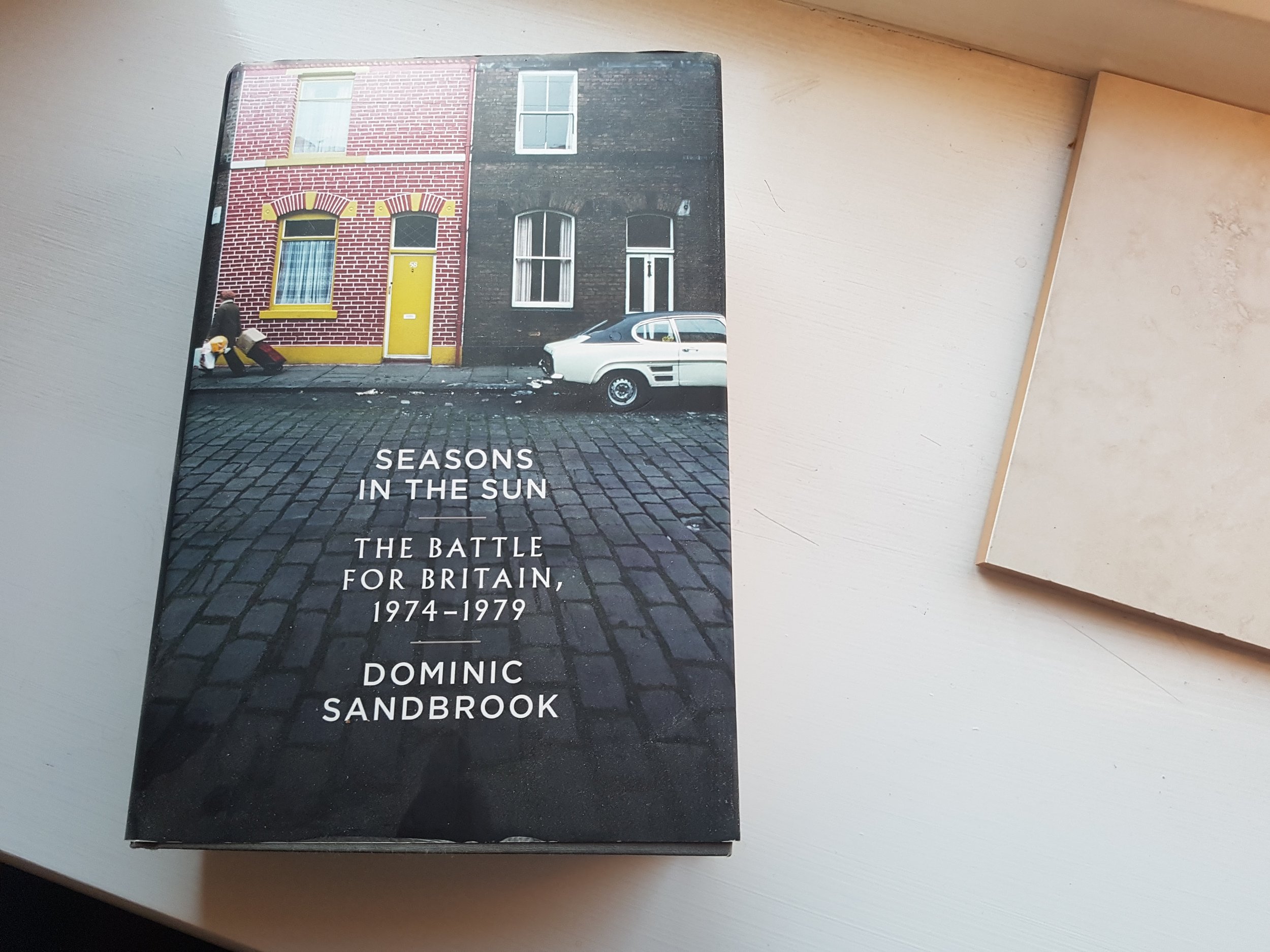

In two magnificent books, Dominic Sandbrook chronicled the seismic events of the 1970s. Rereading these recently, I was struck by the parallels with today's "unique" events.

The fact is that we live lives of continual uncertainty: there never is, or was, a period of calm. At best, there are simply periods of fewer crises.

In reality, we move through life from one "crisis" to the next. Invariably these get - to some degree or not - resolved, until the next one comes along. This is the human condition: thankfully, we are remarkably adept at adapting.

"History never repeats itself. But it rhymes"

The events we are living through now are not unparalleled. They have been enacted before, with different actors and slightly different lines. The world economy, stock markets etc may (may) react differently to current events than they did to previous ones. But we don't know this in advance of the fact.

Yes, past performance really is no guarantee of future returns. Then again, those who ignore history are doomed to repeat it (one good cliche deserves another, after all). In the 1970s, those who avoided the long-term real return potential of equities, for the illusory safety of cash, suffered badly. For the decade onwards from the second General Election in 1974 (this country's lowest peacetime ebb since... forever?):

Makes Clinton v Trump look like an appealing choice

Inflation (as measured by the Retail Price Index) ran at a mouthwatering 12.3% per annum. £100 in October 1974 was worth just £31 by end September 1984.

The Great Companies of the UK (as measured by the FTSE-AllShare) returned 28.7% per annum total return, (including dividends). {Source: Dimensional Fund Advisors}

So investors in the Great Companies of the UK enjoyed a staggering real return (eg over and above inflation) of over 16% per annum.

Put another way, your £100 in October 1974 would have needed to have grown to £320 a decade later, just to keep pace with inflation.

If you had put that £100 into the Great Companies of the UK in the dark, dark days of October 1974, it would have been worth £1,247 ten years later!

So investors not only maintained the purchasing power of their wealth (the sole reason for investing in equities) - they greatly enhanced it, despite a period of enormous social and political unrest.

These figures are not cherry picked. For the forty years from October 1974 to end September 2014, inflation came in at 6% a year, and the FTSE AllShare delivered 15% a year. {Source: Dimensional Fund Advisors}

"But this time it really IS different"

No, it's not. I can guarantee nothing other than there will be awful, seismic events, that will see share prices tumble. These will happen. Maybe tomorrow. Maybe next week. Maybe in twenty years. What history shows us is that all things eventually come to pass.

Those who have the fortitude (and investment education) to understand this will benefit from the Great Truth: your long-term investment returns (eg, your and your family's future wealth and prosperity) are nearly entirely a function of your temperament.

how prepared are you to stick to the plan, when the next verse of rhyming history is being written?

{The above is not specific financial advice aligned to your unique circumstances and requirements. If you act on this article without first reading your own body weight in Key Features Documents, personal illustrations and fund fact-sheets then you may well be struck down by lightning.}

© 2017 Nick Lincoln