Welcome back, Dear Reader, to the latest quarterly missive from Nick Lincoln. This edition has FIVE articles.

If for some bizarre reason you enjoy “The Hat-Tip Newsletter” please do forward it to family and friends.

CASH: STILL TRASH

Yes, cash savings rates have gone up. they are now around half the rate of inflation. whoopee!

Where We Were

Cast your minds back almost precisely sixteen years to July 2007. The headwinds of the Credit Crunch were swirling, slowly picking up and getting ready to send a handful of respected brands (Northern Rock, Bradford and Bingley et al.) into the dustbin of history.

But at that moment, with Gordon Brown Prime Minister, and Michael Vaughan England cricket captain, all seemed relatively calm. The Retail Prices Index (RPI) showed a benign 2% inflation rate over the previous 12 months. Despite this, the Bank of England raised interest rates in July 2007, by 0.25% to 5.75%.

It would be the last interest rate rise for over a decade, as “policymakers” (a polite euphemism, but we will let it slide) printed money and drastically cut interest rates to 0.50% in response to the global banking crisis that reached its nadir in or around March 2009. After a brief spike to 0.75% in August 2018, the Wuhan Lab-Leak Bedwetting saw rates fall again to just 0.10% in March 2020.

Throughout this period, cash savers (people with grey hair, generally) were hammered, and borrowers (people with lots of facial hair, generally) lived in perpetual wonderment. “Five-year fixed rate at 1.99%? Mmm. Not sure. I think we’ll shop around. I’m sure we can do better.” Unsurprisingly, property prices continued to rise strongly; it’s incredible what you can do to the value of an asset class when you’re allowed to borrow and invest in it at a cost of peanuts on the pound….

Inflation was benign throughout this time, and ultra-low interest rates equated to negative real interest rates on bank savings products, e.g. after allowing for inflation (and taxes). For example, in the 12 months to April 2020 (around the start of you-know-what), RPI came in at 2.8%. There were no savings accounts paying anything close to that. So your cash savings were losing value in real terms (the only terms that matter when all is said and done). This is distinctly sub-optimal.

“Most people misunderstand risk. [I] define risk for what it really is, not volatility, but permanent loss and outliving your money. Volatility is a temporary concept that passes with time.”

Situation Now: Cash Is Back?

The historic recent series of base rate rises has seen the 0.10% figure become 5.25%. Whether or not you agree that this is likely to slow down the sudden vicious reemergence of truly wealth-destroying inflation in the UK is a matter for argument; it is what it is. The Cost of Living Lockdown Crisis is real and unpleasant, and the hardship (I think) is only just beginning, especially for those younger borrowers who thought that a base rate over 1% was probably illegal and sexist and racist and homophobic and definitely the result of white privilege or something (I need to get back on my meds. Sorry).

UK inflation remains stubbornly high, at 8.8% in the 12 months to July, although everything is relative: the figure for the year to October 2022 (16.4%) is almost beyond comprehension. At just under 9%, we should be grateful!

As you will be aware, cash interest rates, always lagging but having some sort of relationship to the Bank of England base rate, have finally shown strong upward movement after years and years of general rubbishness (this may or may not be a word). Easy access accounts are now paying around 5% gross, notice accounts a bit more, and fixed-term deposits are breaching 6%. Happy days at last for cash savers?

Sorry.

No.

The Reality

Let’s look at some figures. UK (RPI) inflation is 8.8%. So you need to find a bank paying this rate; otherwise, your cash savings will fall in value in real terms (again, these are the only terms that matter).

There is no bank offering a savings rate of 8.8%. Already, we’re in the territory of “bad news”. Let’s make it worse by injecting a heady amount of reality.

For “fixed income”, read “cash”

The best instant access cash accounts are paying around 5%. Given that you should only have cash for emergencies and unforeseen contingencies, it would seem daft to lock it up for any period, even if that cranks you out a slightly higher interest rate. So, we’ll stick with 5% instant access. Let's assume you have put £100,000 into such an account for ease of maths.

Over 12 months, you get £5,000 of interest before tax. If you are a Basic Rate Taxpayer, you have a Personal Savings Allowance, where the Government generously lets you keep the first £1,000 of interest tax-free. The balance is taxed at your marginal rate (assume 20%).

So £4,000 of your interest gets whacked at 20%, or £800, netting £3,200. Add back the £1,000 tax-free, and you’ve got £4,200 of interest.

Your balance is £104,200. To keep pace with inflation of 8.8%, it needs to be at £108,800.

In real inflation-adjusted terms, the value of your cash is just over £95,000. In just 12 months, It has permanently lost nearly £5,000 of purchasing power. How safe does your cash feel now?

If you’re a Higher Rate Taxpayer (as many now are, as the socialist experiment of the last 25 years or so draws to its inevitable outcome), the figures are worse; long story short: your interest of £5,000 nets down to just £3,200. Here, your cash savings of £103,200 are worth just over £94,000 in real terms.

And if you’re an Additional Rate Taxpayer, reach for the brandy and loaded revolver.

The Centre for Policy Studies July report into the UK’s cash savings situation. Summary: not good.

Cash Has A Place

According to a report published in July by The Centre For Policy Studies (CPS), Britons have more than £2 trillion languishing in cash savings. That’s an insane figure. There seem to be a couple of definitions of what constitutes “a billion”. The one I plump for is a thousand billion; two trillion looks like this (deep breath): £2,000,000,000,000.

And every penny of it loses purchasing power every second of every day; a guaranteed, locked-in (negative) return. It’s enough to make a grown man/woman/he/she/it cry.

For the record, everyone’s financial plan needs cash. Yes, in periods of low and high inflation and low and high-interest rates, it is a rubbish place to hoard your wealth. It invariably drops in value in real terms at almost every moment of every economic cycle.

But it’s there. It’s liquid. It can cover short-term emergencies. It can be leaned on when the rest of your wealth - invested more or less entirely in The Great Companies of The World (GCOTW) - suffers a totally normal and expected temporary decline, and you and I decide we don’t want to be selling into such an event. At that moment, we turn the cash taps on and maintain sufficient lifestyle income until the equally normal permanent advance in the values of the GCOTW resumes.

But please don’t tell me about cash once again being a viable home for anything other than a sliver of your savings. The Dying Legacy Media (DLM) would have you think otherwise. I am here to disabuse you. Where the DLM lives in a la-la-land world of nominal data (“Leading Bank Rates Paying 5%!”), I’m here to politely and firmly remind you that just as nobody lives off gross income but instead lives on net, nobody lives on nominal cash returns but on real inflation-adjusted returns.

The real returns of cash are primarily negative and will destroy wealth by the only measure that matters: purchasing power and ability to fund “Lifestyle”. Everything else is noise.

“The positive thinker sees the inevitable, feels the intangible, and achieves the impossible.”

NOT "FROM" BUT RATHER "TO WHAT?"

PLANNING FOR A HAPPY “FINANCIAL INDEPENDENCE DAY” (RETIREMENT) IS A LOT MORE THAN JUST THE NUMBERS

People work for several reasons. Prime is money. After legal obligations (taxes, mortgages and other kinds of yawn-inducing outgoings) and planning disbursements (saving regularly into tax-efficient pension and ISA pots, etc.), whatever is left goes on Lifestyle (the nice stuff).

Regardless: it’s the payslip at the end of the month that makes the work bearable. If not the case, you are in the wrong job.

Such is the financial necessity of work (“If we don’t get out of bed, we lose the house”) that the intangible benefits of the 9-5 can go unnoticed. The importance of these only emerges when you have perhaps reached Financial Independence Day, and told the boss to shove it. Now you have all of the former working week to ruminate. Hours upon hours. And there’s only so much golf/bridge/whatever you can divert yourself with.

Something aside from the payslip is missing.

Turns out that the missing thing is other people.

And the research supports this. A Harvard study began in 1938 (!) in which 724 participants were asked questions about their lives at regular two-year intervals. As the study group grew older, the questions posed focused more on retirement issues. And one recurring theme dominated: relationships.

“As participants entered mid- and late-life, the Harvard Study often asked about retirement. Based on their responses, the No. 1 challenge people faced in retirement was not being able to replace the social connections that had sustained them for so long at work.”

The group has numerous stories, from the Doctor with a 50-year career who missed “absolutely nothing about the work itself. I miss the people and the friendships”, to the teacher who got “spiritual sustenance from talking shop. It’s wonderful to help someone acquire skills. Teaching young people was what started my whole process of exploring.”

A stereotypically awful stock image of a supposedly retired couple with the omnipresent bloody beach.

Rampant opioid crisis in the USA notwithstanding, in the West we are living longer lives. A three-decade-long retirement is not the exception: it’s become the norm. How exactly will you get a purpose from that time? How will you replace the human interaction? I know you think you can’t abide Colin from Human Resources but it turns out you actually miss his inane Monday morning witterings about the latest episode of Strictly Baking or whatever it’s called.

So what are you retiring to, exactly?

This is the pressing retirement question of our time (after the money one, which I’m here to help answer for you). So much so that there is a burgeoning cottage industry emerging, devoted to helping answer that question for you.

I can’t pretend I’ve read all the books in the following list. But if you are on the cusp of reaching your Financial Independence Day, I would suggest you could do a lot worse than chew through two or three random choices and give yourself some retirement-to-what food for thought.

In no order, here are some well-regarded, generally short and snappy works:

The numbers are just one side of the coin

I work as a financial planner/adviser/whatever. I help people organise their affairs so they can live dignified and independent retirements without fear of later on running out of money. It’s great work, I love it, and my clients are friends and vice-versa. But that’s just one side of the retirement coin. Make sure you actively think about the other side.

The question of our time is no longer “What are you retiring from?” It’s “What are you retiring to?”

“If I’d known I was going to live this long, I would have taken better care of myself.”

AUTUMN PRACTICE UPDATE

GOD CAN STUFF HIS “FORCE MAJEURE”

Nick Lincoln, IFA and owner of V2VFP Ltd

Did you notice the summer? It started strongly in May and June, then faded to nothing for weeks on end before coming back for a few long days of Indian warmth, ending right about….. now

Mostly, then, summer here was conspicuous by its absence: on the Continent, the Dying Legacy Media couldn’t wait to tell us about the latest outpouring of perfectly normal “summer”, with every weather chart decked out in various shades of any colour, as long as it’s red. When did that become a thing?

Fear not, Dear Reader: Winter will be here soon and the news cycle will switch to elderly people dying of cold weather, failing electrical grids, and zero power from wind turbines that don’t work when the, er, wind drops (hold that thought: wind turbines not working in windless conditions is a year-round story. My apologies.)

To get our yearly dose of Vitamin D, The Lovely Penelope (TLP) and I bolted for Taormina, on Sicily’s eastern coast. We had a fantastic scheduled seven nights: great food, a beautiful location for our hotel, and perfect weather e.g. consistently hot.

It was all going so well until we had to return home. “Man plans and God laughs", and all that.

Your author with something smokin’ hot and volatile. Also: Etna is in the background.

In the early hours of the day of our departure, Mt Etna had one of her episodes and dumped ash all over Catania. This is not something that would normally concern me a jot. Except we were flying out of Catania back to Lincoln Lodge, and jet engines and ash do not a happy marriage make.

Cue chaos at the airport, a complete lack of available flights back, and four extra nights in high-season city heat, with no pool and no beach nearby. I know: pity me, right? But it was scorching and there was no relief, and - far worse - I had no clean underwear; for the first time in my life I had to use our emergency hotel’s laundry and ironing service: a snip at 150 Euros (seriously).

On our (eventual) return, I submitted a travel insurance claim, only for wiggle room to emerge via the dreaded “force majeure” clause. Seems a bit rum to me: we didn't want the extra four nights in Catania and didn’t fancy sleeping rough, so a hotel room seemed a practical solution. Nor did we eat lavishly, cutting back to just seven courses for dinner; sacrifices must be made.

Anyway, the insurance is picking up some but by no means all of our claim. So be careful what you wish for; all through the planned first seven nights of our break, I’d wished for a small eruption from Etna. Nothing big; no dead humans, perhaps a bit of scorched livestock,

In the early hours of our day of departure, my wish was granted. I didn’t get to see it, and am about £800 down because of it. Again: be careful what you wish for.

Practicing Gratitude

Another business year closed on 30th June. I started on my own in 2008 with a tiny handful of clients from my previous firm.

Nearly all of these lovely peeps (friends) remain with me. To them and all who have joined me along the way: I thank all of you for your continuing faith in my services. To the casual reader: thank you for your time.

Until the Winter, then, Dear Reader. Take care.

“Government’s view of the economy could be summed up in a few short phrases: if it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidise it.”

A REFLECTION ON CRYPTO

IN A QUIET ENGLISH VILLAGE, FARCE BECOMES TRAGEDY

I’ve not ruminated much on cryptocurrency and the whole hype machine that goes with it. You may have intuited my silence as a general disapproval of the whole thing.

And you’d be right.

Recently, general disapproval has morphed into loathing. Out-and-out fraudsters such as Sam Bankman-Fried, are part of my distaste; has there ever been a sector so surrounded by hucksters and obvious sharks?

Then there is the “get rich quick” greed mentality that seems to permeate the minds of those drawn to this “asset” class. Buying something they don’t truly understand (disclaimer: I don’t understand it at all, and I’m quite happy, thanks) in the hope that they can find somebody else down the line equally as bereft of an idea as to what crypto actually is but who will nevertheless pay more for it than they did, because “crypto”.

It’s all nonsense. From a financial point of view, crypto resembles gold, in so much that it:

Has no intrinsic value

Produces nothing and hence has no earnings (profits)

Generates zero income (no dividends, no interest)

The Crypto Rollercoaster

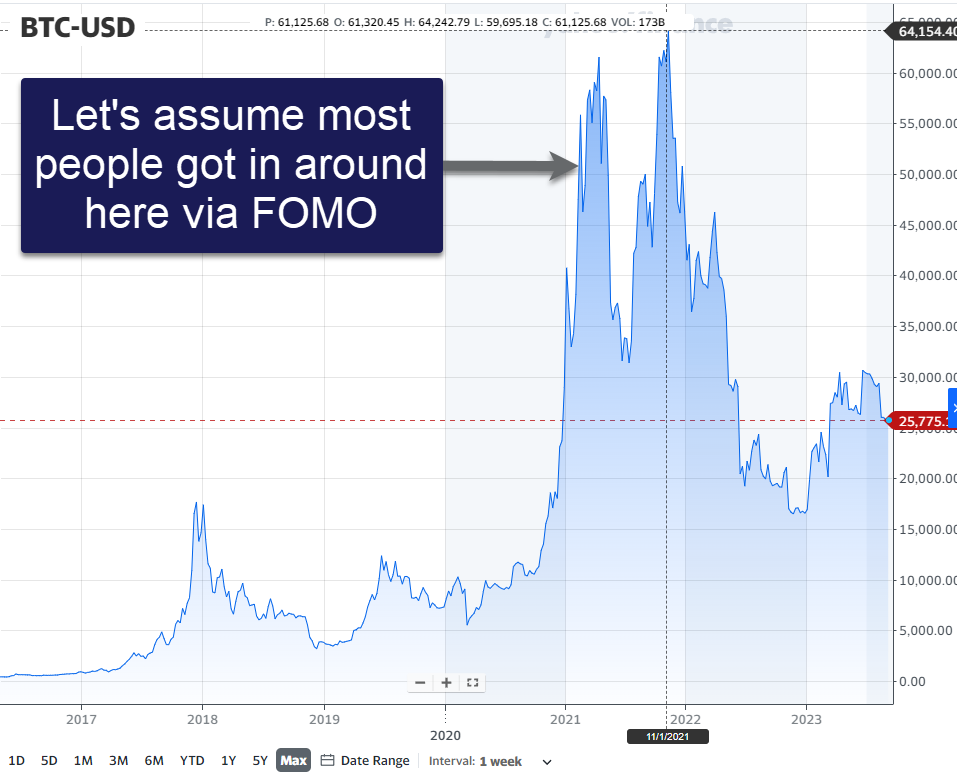

The rollercoaster ride of Bitcoin is something to behold. From a peak of around $65,000 in late 2021, it’s lurking at around $26,000 now. That’s a temporary (permanent?) decline of 60%. As ever with past performance, most Bitcoin holders won’t have actually benefited from the good old days. I can’t prove it but I’d wager a small fortune that most money into Bitcoin happened after its price had risen sharply. Fear Of Missing Out (FOMO) is stupendously powerful.

Throw in The Wuhan Bedwetting and you had a lot of people idling around working from home with hours to kill, with a keyboard and screen practically begging them to misbehave in a myriad of ways, some of which involved “Click Here To Buy BitCoin NOW” etc.

Source here.

Having got in when the price had already appreciated significantly, the FOMO saps have had to sit through one precipitous decline, a sharp recovery, and now are in a steeper, nastier fall, albeit one that has bounced a little from its bottom.

What a journey. What misery. And the misery is real.

You know when Average Joe/Jo gets their pulses raced by “the next big thing” it won’t end well. And so it’s proving. The lovely rural village of Winchmore Hill (not the North London enclave but one set in rolling Buckinghamshire countryside) has had its own version of FOMO mania. And it’s not ending well, sadly.

“In my naïve days of thinking investment pitches were important, the raciest presentations involved a buffet lunch, branded biro and squeezy ball; if you were lucky, a fridge magnet might be thrown in.”

Porn Stars and Fast Cars

Inspired by the publican (!) of village pub The Potters Arms, residents of Winchmore Hill were tempted to invest in a crypto variant called Koda (me neither). Promotional events around Koda involved porn stars, entertainers and Lamborghinis: “lucky” investors in Koda could win a sports car. In my naïve days of thinking investment pitches were important, the raciest presentations involved a buffet lunch, branded biro and squeezy ball; if you were lucky, a fridge magnet might be thrown in.

In other words, red flags were everywhere. Yet, human nature being what it is, the denizens of Winchmore Hill invested speculated in Koda. Some lost all their life savings. So much worse: one poor soul took his life over the débâcle.

If the article above is not enough for you, the BBC has also produced a podcast on this sorry story (it’s very BBC, so expect a lot of people complaining about how they were duped, and exactly no pushback of the “what the hell were you thinking?” variety).

Nick clutching a bag of Scampi Fries, when his heart was yearning for pork scratchings.

In the interests of research - and to get out of my office where I was slowly being boiled alive by this most Indian of summers - I drove the 12 miles or so to The Potters Arms. It’s a perfectly pleasant place, the kind of quaint countryside hamlet that this country effortlessly produces. Normal people; the chap on the garden table next to me was a butcher “before Tescos moved in and did for everyone.” Decent pint (no pork scratchings but we’ll let that slide).

Into this perfectly lovely English Mrs Marple setting, madness descended. The madness of crowds is a thing. FOMO is a thing. And it nearly always ends badly.

I have a couple of clients who have speculated in crypto. You know who you are. I’m an amiable doofus and forgive you. It’s your money, after all, and having a little excitement via a ROBA (Rush Of Blood Account) is perfectly fine with me. But for anyone thinking about crypto as a long-term investment: think twice.

I won’t warn you again.

let’s not be cryptic with crypto et al: if your publican recommends an “investment” to you - run for the hills

INFLATION IS TO RETIREMENT WHAT CARBON MONOXIDE IS TO HEALTH

This is a recurring piece. Each quarter the figures will be appropriately updated. Why? because while the numbers will change around the edges, the message is eternal!

A typical retired couple may well see one partner live for three decades or more. Over such a long period, the annual cost of Lifestyle could easily more than triple. Says who? Says me: financial planning involves enormous ambiguity. If you want certainty, die now.

So an example Lifestyle cost of £50,000 per annum entering retirement could later escalate to £150,000 or more a year, just to keep standing still, to keep buying the exact same “stuff”.

If you really must, some prosaic evidence: in 1993 a First Class stamp cost 25p. Now? £1.25. See the detailed graph below:

Some nuggets to lessen the gloom (past performance is no guarantee of future returns etc):

Three decades ago - Autumn of 1993 - the S&P 500 (The Great Companies of The USA) was valued at 459;

Today, 30 years on - Autumn of 2023 - The Great Companies of The USA are valued at c.4,500;

In three decades, these Great Companies have grown in value by a factor of ten;

In addition, the dividends paid by these Great Companies have risen five-fold in those 30 years.

The last three decades have seen four "get me out of here I can't stand it anymore" bear markets (2001-3, 2007-9, Q1 2020 and right now) and numerous smaller temporary declines.

Source for US market figures here. Why US data and not the UK? Because the Yanks have this kind of thing publicly available and we don't - yet. Also, the US market is enormous. By comparison, the UK market - at under 5% of worldwide market capitalisation - is tiny.

Dear Reader, the big risk to a dignified, independent retirement Lifestyle is the destruction of purchasing power via inflation. Like carbon monoxide, you can't hear it, smell it, see it, taste it. Yet inflation will silently, stealthily kill your wealth.

The cure? Possessing a Financial Plan fueled by ownership of The Great Companies of The World: equities.

The problem with the cure? It's really really hard to stick with your Plan and stay invested through the horrendous-but-always-temporary-declines. The cure for the cure? Having a tough-loving, empathetic counsellor to stand between you and "the big mistake".

Having stated the problem, and maybe scared you witless, I hope the above figures give you a glimpse as to the only rational, moral solution for a healthy couple facing a three-decade plus retirement!

“Inflation: odourless, tasteless, and utterly poisonous to a dignified, independent retirement.”