Welcome back, Dear Reader, to the latest quarterly missive from Nick Lincoln. This edition has FIVE articles.

If for some bizarre reason you enjoy “The Hat-Tip Newsletter” please do forward it to family and friends.

YOU ARE JUST A POT OF MONEY

AND OFTENTIMES, YOUR POT IS TOO SMALL FOR THEM TO CARE

Personal finance is just that - personal. Helping people to achieve deeply held personal goals and ambitions without fear of later on running out of money often involves deep conversations that frequently are not about the money at all. Clients will say things to their trusted financial adviser that they would never mention to their other professional connections. Over time this leads to deep relationships, founded on mutual trust and respect.

This is reinforced by the nature of UK financial advisory businesses. The vast majority are - like mine - owned and run by the advisor(s). It behoves the owner/financial advisor to do nothing other than the very best for her clients, all of the time, without exception, because these people are, bluntly, her income.

These client relationships can span decades. I’m working with client families who have been under my stewardship since the early 2000s.

As an owner/advisor I know - and my clients know - I’m not going anywhere else in the foreseeable future. My business is not going to be acquired and subsumed by some financial behemoth (although I’m open to offers…..) No one is going to headhunt me. In short, I am never going to be an “employee” again. Been there, done that etc.

Compare and contrast the above with a recent experience suffered by long-standing (of course!) clients of mine. The late father of one of these particular clients had, around 16 years ago, set up a trust fund, managed by Kleinwort Hambros. I was not involved.

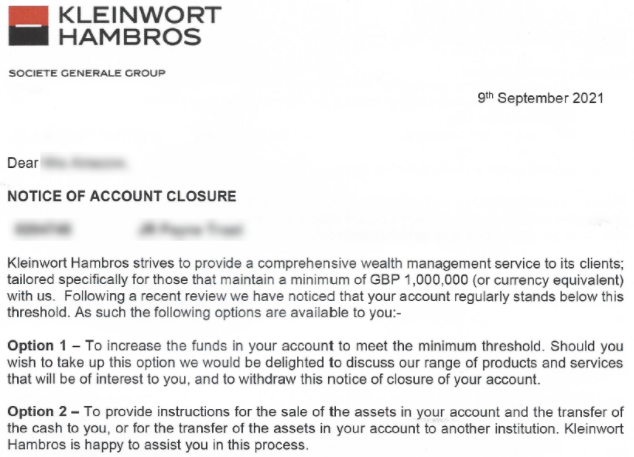

My clients are the current beneficiaries of the trust fund income. All well and good. Until the letter below landed like a bucket of cold sick:

In short: “We know that your Dad entrusted us to look after the trust fund for you in perpetuity. But Dad’s not around anymore and, frankly, your pot of money - which we’ve gladly been taking hefty fees from each year - just isn’t big enough for us now. Our swanky offices won’t pay for themselves!

So unless you’ve got another £800,000 or so lying around in loose change, please bugger off ASAP.”

This is a pro-forma letter, perfunctory, lacking in any empathy or genuine feeling. I imagine thousands of these have gone out to “clients” of Kleinwort Hambros. Signed off by the “Head of UK Domestic Private Banking”, who may or may not be there in a year or two.

At the risk of bashing this into the ground like a tent peg, it should also be noted that the fund performance of the underlying trust investment has been almost comically awful. The fund returned under 11% in total for the five years to the end of November 2021:

My take? Big financial institutions care not a jot about the people who entrust them with their money, for various reasons:

““The fiduciary standard of care requires that a financial adviser act solely in the client’s best interest when offering personalized financial advice.””

You’re just too small. Even if you invest millions, you’re just a drop in the ocean.

If you leave or are unhappy, the company will be on to the next sale with the next “client” before your account closing statement is in the post.

There is no real client-advisor relationship. At all times your “advisor” is likely to get promoted/sacked/a better job elsewhere.

The relationship is all about your money, or rather, your investments with them. Rarely if ever is financial planning carried out.

Mea culpa: I have a vested interest in celebrating the client benefits of working with owner-advisor firms because I am one. However, hand on heart, the very best people I mix with in my profession are those who are the same: owner/advisors with the fiduciary standard running through their veins. Not because they are required to by legislation. Rather, because it is in their own rational self-interest.

Do right by their clients and the owner-advisor will do right by herself. It behoves us to behave, at all times, lest we damage our brand, personal name and, consequently, our business.

Small, independent (in the truest sense of the word) owner-advisor businesses knock larger financial advisory businesses out of the park.

I have seen too many of the above incidences. Frankly, it sickens me

“Everybody gets so much information all day that they lose their common sense”

FOR THE MANY, NOT THE FEW?

CRONY CAPITALISM & RENT-SEEKERS: THE UNIONS WILL PROTECT US!

In July 2020 Tim Roache “concluded his employment” as the General Secretary of the General, Municipal, Boilermakers and Allied Trade Union (GMB), the third-largest union in the UK in terms of membership (which includes the International Union of Sex Workers - yes, really.)

According to our good friends The Taxpayers’ Alliance, Mr Roache’s annual remuneration was £288,000. As a leaving present, he was also given an additional £80,000 lump sum. Given that he left under something of a cloud, the headlines at the time focused on these amounts in the mortally indignant way elements of the Dying Legacy Media tend to do.

Slipping under the radar somewhat was the fact that Mr Roache is also entitled to a £60,000 annual pension. Sounds harmless, right?

Wrong.

Simply put: a 59-year-old male (for that is our subject’s age) would need to accrue around £3,200,000 in a personal pension-like arrangement, to be able to purchase a guaranteed, index-linked annual pension income of £60,000. I believe Mr Roache is married. If you want to build in a spouse’s pension then you would need an even bigger pot.

Does it not strike you as it struck me that this is somewhat obscene? By age 59, to get a pot of £3.2M, you’d need to squirrel away over £4,600 per month, month-in, month-out, for 25 years, assuming a no-way guaranteed net return after charges of 6% per annum. Not many 34-year-olds have a spare £4,600 lying around after meeting the mortgage payment and life’s other regular outgoings, including, for example, union membership dues…..

Without getting too enmeshed in the weeds, it’s also worth noting that anyone who has by some miracle accumulated £3.2M in a personal pension pot is going to be whacked with punitive taxes for exceeding something called the Lifetime Allowance (LTA). Mr Roache is likely also to fall foul of the LTA but - because of different ways of calculating the LTA depending on which type of pension scheme you belong to - his tax charge will be significantly lower.

All in it together? Do me a favour. Crony capitalism is alive and well

“A government big enough to give you everything you want is strong enough to take everything you have.”

WINTER PRACTICE UPDATE

WHISPER IT BUT THINGS CONTINUE TO GET BETTER

Nick Lincoln, IFA and owner of V2VFP Ltd

They can give it as many variant names as they want but “it” is over. Finito. Done. Whatever the utterances of Prime Minister Carrie Johnson, this pandemic is history.

Patently, people have had enough of having their liberties infringed upon. You can hear it in conversation. You can see it in the shops and on public transport, where mask-wearing is mandatory and yet many are maskless, and no one says anything.

I know people who have complied with every diktat the State has issued over the last two years. These same people are saying that if Johnson and his spineless cronies at SAGE cancel Christmas again they are going ahead regardless. Families will gather, under one roof, and enjoy each others company (for a few hours at least, until the old enmities resurface. Bah humbug!)

“vaccine

/ˈvaksiːn,ˈvaksɪn/

noun

a substance used to stimulate the production of antibodies and provide immunity against one or several diseases,”

In our household, in early October, we all had Chinese Flu Delta Variant Number 542. No issues or worries although I lost a considerable amount of weight (which, alas, has been just as rapidly regained).

I caught it off my double-jabbed partner Penny: whatever it is that people are injecting into their immune systems, it ain’t a vaccine in the accepted sense of the word.

Without question (and from experience), what the jab does do is ameliorate the symptoms and, for the vulnerable, that is a jolly good thing.

And of jollies, I’ve had a few in London these past couple of weeks and it’s been a joy to see the city come back to life. The traffic is awful, the trains have been standing room only on occasion, and I’ve never been so happy to suffer these minor inconveniences.

At the end of last month, I even attended an in-person conference! Organised by my good friend and fellow IFA Andy Hart, “Humans Under Management” is the premier annual adviser event. As in previous years bar last, over two hundred paying attendees congregated at the lovely Royal College of Physicians on the edge of Regent’s Park to listen to a great speaker lineup (and me).

Nick captivating his audience. Probably.

The subject of my talk was a lengthier rendition of the inflation article I wrote for the Autumn newsletter. It was well received and the whole day was great fun, as people caught up with each other for the first time since you know what. And there was definitely a sense of the Christmas spirit in the air.

Things are getting better, all the time, and they will be that much better again in 2022 if we determine that is what we want.

So, dear clients/friends, as this year comes to a close - to be consigned to the “Thank God that’s behind us” folder that already contains 2020 - and with both of us teeming with natural t-cell immunity and the resulting innate smugness, Penny and I wish you a Merry Christmas and a Happy New Year. We think it is going to be a good one.

“Almost everything will work again if you unplug it for a few minutes - including you.”

FOUR: IT ALWAYS RHYMES

“HISTORY DOESN’T REPEAT ITSELF - BUT IT OFTEN RHYMES”

In July 1932, as the US weathered a seemingly interminable Great Depression, the antipathy towards equities reached a nadir. The Great Companies of The USA, as valued by the S&P500 index, had fallen a further 68% over the previous 12 months, leaving the index hovering at around…. five. Yes, you read that correctly. Five.

The giddy mania of the ‘20s seemed less a distant memory than a sick joke.

With hindsight, it was the perfect opportunity to buy the shares of the Great Companies. The greatest opportunity ever. Maybe not obvious to the woman in the street but surely a pulsating “buy” signal to investment professionals, no?

As it happens, “no”.

As the Wall Street Journal extract below from July 1932 points out, professional money managers (“investment experts”) were doing the exact opposite. Instead of buying up the Great Companies at never-to-be-seen-again prices, these boffins were selling out of them and reinvesting the meagre proceeds into Government bonds.

Having placed their investor’s money in “safe” Government bonds, the investment whizkids of Wall Street looked on as over the next 12 months the S&P500 delivered a total return including dividends of 163%.

The US market was to lurch up and down in a similar fashion through the rest of the decade as it tried to fathom out just how bad Roosevelt’s New Deal was for everybody except those handsomely rewarded for administering it (crony capitalism takes seed around this time).

Even allowing for a second slump lasting five years from March 1937, a brave investor would have seen an annualised return of around 13% over the decade from the publication of the above article from 1932 (source for all figures: Dimensional Fund Advisors).

Is history repeating itself in 2021?

Maybe not but it is, as often said, rhyming, as investors find new ways to destroy their wealth (as defined by purchasing power). This time, instead of turning to Government bonds as a result of a seemingly-bottomless but eventually temporary stock market decline, investors are still piling into cash despite the explosive growth in global stock markets since March 2009. This is at a time when UK inflation is getting ever closer to 5% per annum.

“...whilst cash ISAs pay less than 1%, inflation is at a ten year high, galloping on currently at 4.2%. The British people saved a whopping £4.8bn into cash ISAs [in] 2019/2020...”

The above quote is taken from a trade publication that reveals nearly £5bn went into Cash-ISAs earning less than 1% interest in 2019-20. Given that the Great Reaction to Chinese Flu was kicking off right at the end of that time - in March 2020 global markets fell by the largest amount in the quickest time ever - one can reasonably infer that a whole load more cash was subsequently shovelled into these ISAs.

This is insanity on two stilts:

Joe Public - still petrified by the events of The Credit Crunch a near-decade and a half-ago - has turned his back on the stock market for the illusory safety of cash, and therefore missed out on the explosive recovery and permanent advance experienced by the Great Companies of The World (GCOTW) since.

Even worse, he has chosen a store of value (cash) that, allowing for inflation, is guaranteed to fall in value each year if you define value as purchasing power (and at the end of the day, all of us are worried about one thing and one thing only: have I got “enough” to fund my lifestyle now and for the rest of my days?)

For forever, the culture and its enabling Dying Legacy Media has screamed that risk is everything to do with the vagaries of the “stock market” and nothing to do with the destruction of purchasing power via inflation. The above stupidity is the result.

Dear client/friend: we lucky few know better. We know the declines are temporary, the advance is permanent, and that our portfolios are nothing more than a function of our financial plans. Let others ignore the lessons of time: our history class is A+ for effort and attainment!

History doesn’t rhyme but it does repeat. with most investors, it repeats all the time

“In general, the art of government consists of taking as much money as possible from one party of the citizens to give to the other.”

INFLATION IS TO RETIREMENT WHAT CARBON MONOXIDE IS TO HEALTH

This is a recurring piece. Each quarter the figures will be appropriately updated. Why? because while the numbers will change around the edges, the message is eternal!

A typical retired couple may well see one partner live for three decades or more. Over such a long period, the annual cost of Lifestyle could more than triple. Says who? Says me: financial planning involves enormous ambiguity. If you want certainty, die now.

So an example Lifestyle cost of £50,000 per annum entering retirement could later escalate to £150,000 a year, just to keep standing still, to keep buying the exact same amount of “stuff”.

If you really must, some prosaic evidence: in 1991 a First Class stamp cost 24p. Today? 85p. See detailed graph below:

Some nuggets to lessen the gloom (past performance is no guarantee of future returns etc):

Three decades ago - Winter 1991- the S&P 500 (The Great Companies of The USA) was valued at 388;

Today, 30 years on - Winter 2021- The Great Companies of The USA are valued at c.4,500;

In three decades these Great Companies have grown in value by a factor of 12;

In addition, the dividends paid by these Great Companies have risen five-fold in those 30 years.

The last three decades have seen three severe "get me out of here I can't stand it anymore" bear markets (2001-3, 2007-9 and Q1 2020) and numerous smaller temporary declines.

Source for US market figures here. Why US data and not the UK? Because the Yanks have this kind of thing publicly available and we don't - yet. Also, the US market is enormous. By comparison, the UK market - at under 5% of worldwide market capitalisation - is tiny.

Dear Reader, the big risk to a dignified, independent retirement Lifestyle is the destruction of purchasing power via inflation. Like carbon monoxide, you can't hear it, smell it, see it, taste it. Yet inflation will silently, stealthily kill your wealth.

The cure? Possessing a Financial Plan fueled by ownership of The Great Companies of The World: equities.

The problem with the cure? It's really really hard to stick with your Plan and stay invested through the horrendous-but-always-temporary-declines. The cure for the cure? Having a tough-loving, empathetic counsellor to stand between you and "the big mistake".

Having stated the problem, and maybe scared you witless, I hope the above figures give you a glimpse as to the only rational, moral solution for a healthy couple facing a three-decade plus retirement!

“Inflation: odourless, tasteless, and utterly poisonous to a dignified, independent retirement.”