Welcome back, Dear Reader, to the latest quarterly missive from Nick Lincoln. This edition has FIVE articles.

If for some bizarre reason you enjoy “The Hat-Tip Newsletter” please do forward it to family and friends.

RIVER OR RESERVOIR: IT'S ALL WATER

IT’S TIME TO LAY TO REST THE BUNKUM THAT IS THE DIVIDEND FALLACY

That Wuhan Thing - or rather our reaction to it - has various knock-on effects. Economically it is a disaster. Specifically, for the purposes of this piece, it already mightily impacts retirees living off dividend income. It may well be the final nail in the coffin for the “Dividend Fallacy”.

“May” is the operative word here. The idea of collecting dividends as a risk-free income stream has been around since forever: I remember my paternal grandfather talking about the dividends he received from a small basket of shares, and chances are his grandfather did the same.

The Dividend Fallacy is based on three misconceptions:

Dividends are somehow unrelated to a company’s share price.

Price fluctuations in a company’s share price are irrelevant because the dividends will just keep on coming regardless.

Any other way of extracting “income” from a share portfolio or fund must involve the risk of capital erosion. Having a pure dividend income strategy avoids this trap.

“Annual income twenty pounds, annual expenditure nineteen nineteen and six, result happiness.

Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery.”

The first misconception somehow imagines a world where private companies have a separate money tree that magically churns out the folding stuff for dividends, and that paying out said dividends in no way lessens the balance sheet strength of the paying company.

This is nuts. Per Investopedia: “After a stock goes ex-dividend, the share price typically drops by the amount of the dividend paid to reflect the fact that new shareholders are not entitled to that payment.”

So if your £100,000 share portfolio declares a £5,000 dividend payment, your portfolio is now worth £95,000. Sound to me exactly the same as taking a £5,000 capital withdrawal from your share portfolio, no? More on this in a minute.

The second misconception - that dividends will just roll in so don’t worry about share price fluctuations - has had the stuffing knocked out of it over the last year or so (as it did during The Great Recession of 2007-9). Per UK Dividend Monitor Q1 2021:

UK dividend payouts fell 26.7% to £12.7bn in Q1 2021 year-on-year on an underlying basis;

Q1 cuts totalled £5.8bn – about half came from the oil sector;

Over the last twelve months, the pandemic caused a 41.6% fall in dividends – cuts totalled £44.8bn, as two-thirds of companies made reductions.

Imagine relying on dividend income in retirement and for said income to fall year-on-year by 42%! Cue a long line of disgruntled retirees knocking hard on the door of chez Lincoln.

And talking of share prices and dividends, we can’t afford to ignore the growth potential of companies such as Facebook, Netflix, Apple et al, who for years didn’t - or still don’t - pay any dividends whatsoever.

These burgeoning companies take the view that they can use their capital to better effect than to simply dole some of it out to their investors via a dividend. If you exclude companies such as these it reduces diversification and reduces potential return in the long term.

The third and final misconception is that taking capital withdrawals from a portfolio has an increased chance of capital erosion over pure dividend income. As we saw earlier, a dividend payment reduces the value of a company’s share price by the amount of the declared dividend. Dividends erode capital value!

“I have long said that no one should invest in equities for income. If you had invested in the IA UK Equity Income sector over the past five years, you would on average have lost nearly 1.3 per cent a year. The best way to approach this is to invest for the highest total return you can achieve and sell whatever shares or units you need to provide cash. However, I realise that for many investors, the idea of realising part of their capital to provide income is anathema. So what to do?”

Terry Smith is one of the UK’s most respected fund managers. He’s certainly the most entertaining (from an admittedly small pool). His quote above sums things up nicely, especially the fear investors have in selling down capital to provide “income”. How do you ensure you are not taking too much out of your portfolio, that your withdrawals will be sustainable?

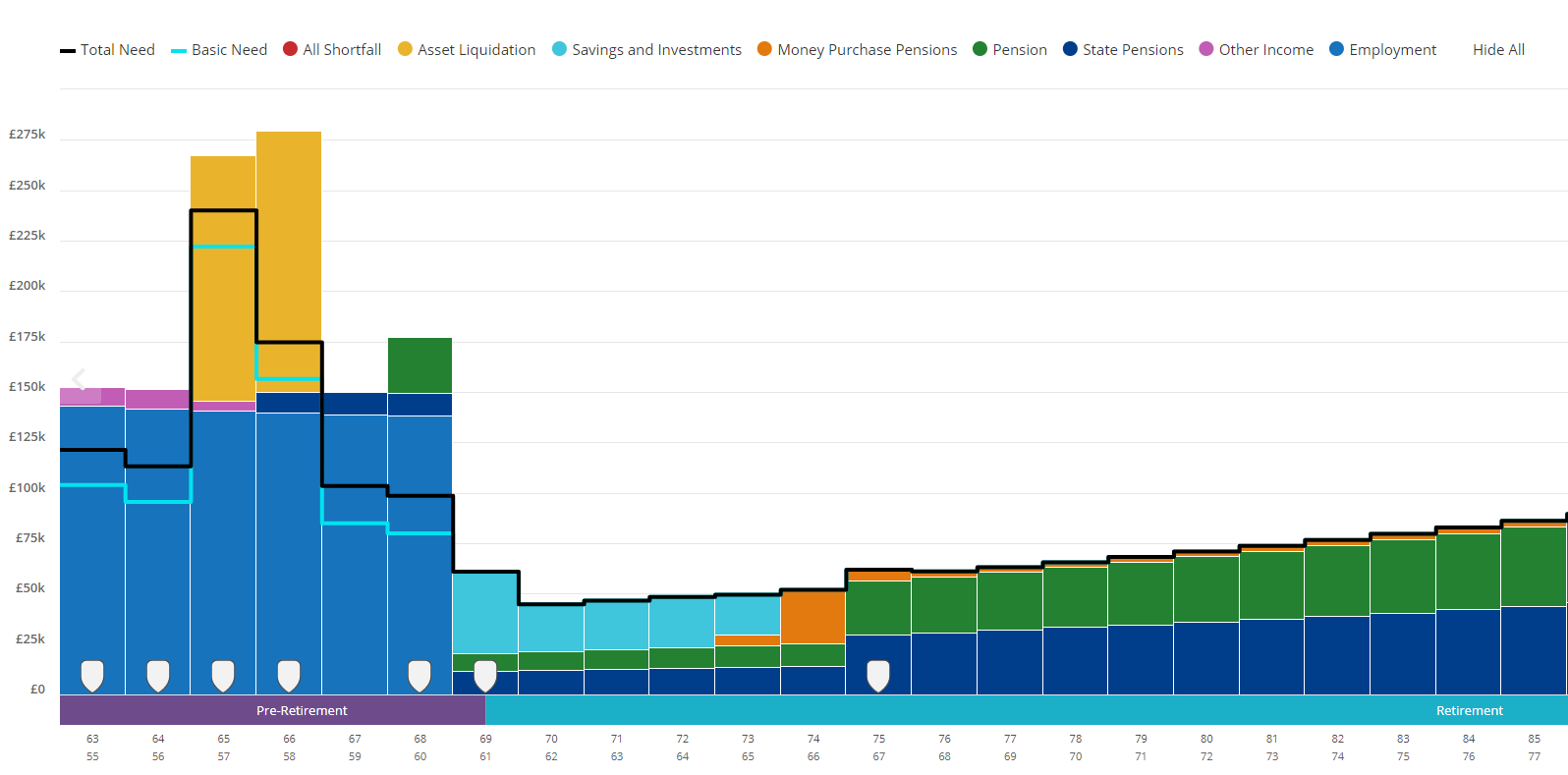

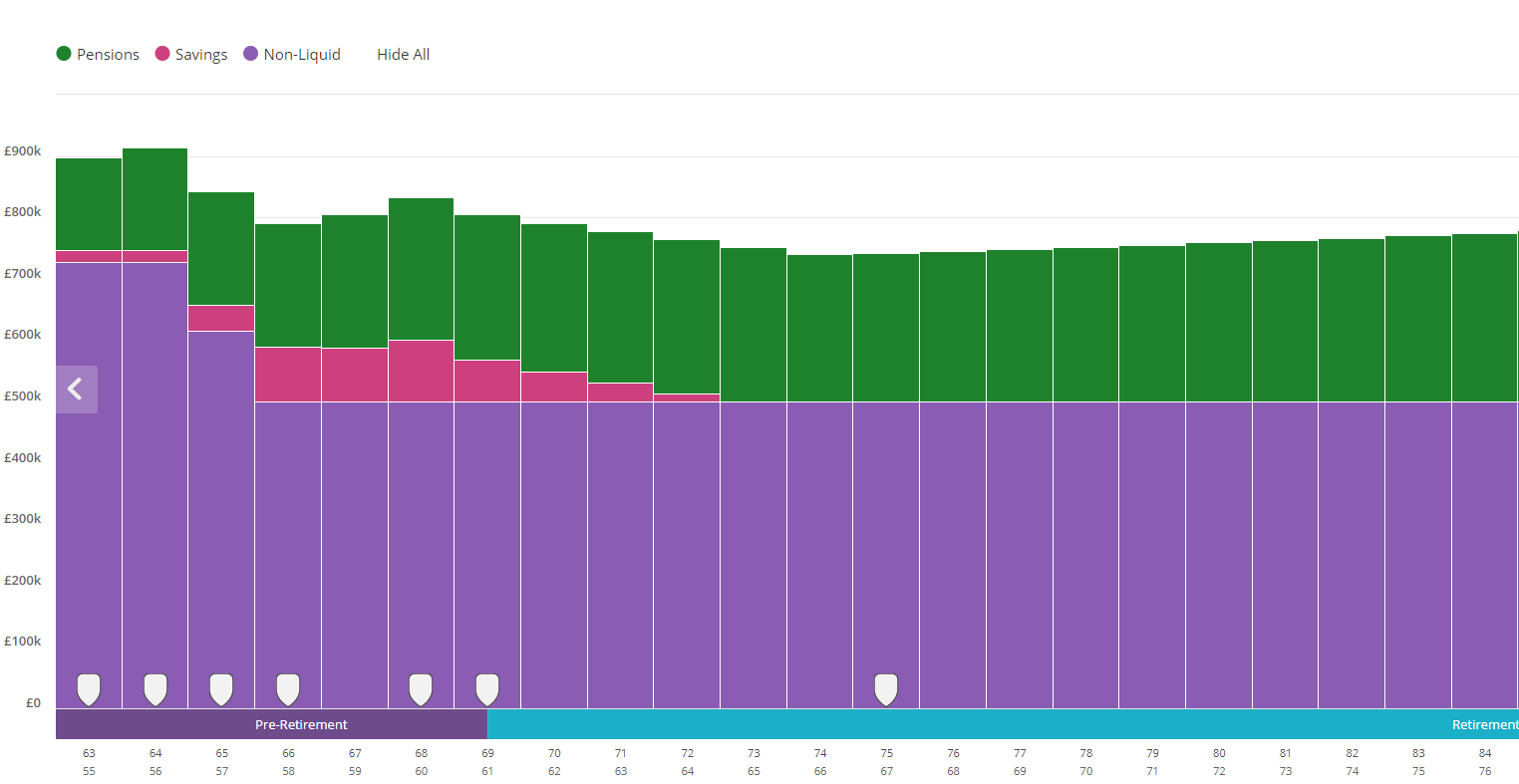

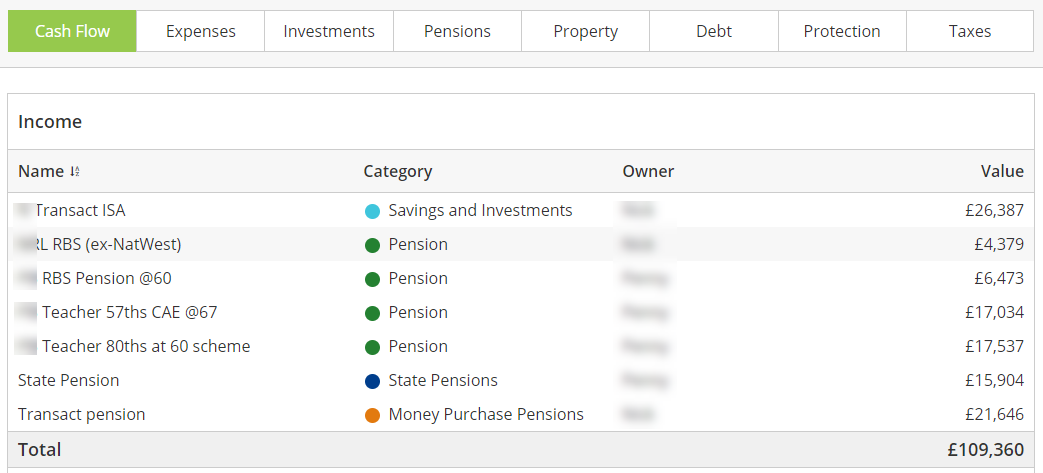

We use cash flow modelling extensively at Values to Vision FP, especially so when constructing portfolios designed to throw out an acceptable level of “income” for those entering or already in retirement.

The cash flow modelling graphically shows people how sustainable their retirement income is likely to be, and from where it will be sourced (eg State pension, rental income, taking regular payments from personal pension pots etc). As you may expect, we do not use a dividend strategy in planning retirement income cash flows. Instead, we use a “total return” approach that reinvests dividends back into the portfolio, from which regular, fixed, monthly withdrawals are made.

Such an approach would have given my grandfather the willies. A generation raised on the David Copperfield concept of not spending a penny more than the income you receive would surely baulk at the idea of taking slices of capital to fund lifestyle.

But times change. Again, it’s all water. As long as you don’t dip too heavily into the well on too regular a basis, you should be OK (nothing however is guaranteed). Financial planning involves a heavy degree of informed guesswork. You have to be able to tolerate a decent amount of ambiguity.

This is perhaps the main reason why it’s important to have your retirement cash flow model updated annually, so as ensure that the “income” you are seeking looks to remain sustainable over the years and decades. But I would say that, wouldn’t I?!

Whether you take dividend income or capital withdrawals to provide a de facto income stream, it’s all coming from the same pot! It’s all water

BEAR MARKETS: A LOVE LETTER

20% PEAK TO TROUGH DECLINES ARE LIKE “LOVE ISLAND” CONTESTANTS: COMMON, DULL, AND NOT WORTH WORRYING OVER

The technical definition of a bear market is when an index such as the FTSE-100 falls by 20% or more from its previous high. Don’t ask me why 20% matters: it’s arbitrary. It’s just a number. But it’s the number used, so we stick with it for these purposes.

When markets decline by 20% from previous highs, the reportage is overwhelming. Couple it with a pandemic and the Three-Headed Monster that is Kuessnesberg-Peston-Rigby (KPR) is in Seventh Heaven. Not only did the Prophets of Doom have a pandemic to scare us with in the first quarter of last year: concurrently the values of The Great Companies of The World fell faster than they had ever done.

Yet by just mid-August 2020 many of these Great Companies had seen a total recovery in their share prices. On this KPR was strangely silent. This was and is ever the way of the dying legacy media. It is all “holy crap, look at this, we’re all doomed” on the way down, and “nothing to see here” on the way back up. Rinse and repeat every few years.

But in exactly how many years do bear markets - these end-of-time events - occur? More often than perhaps you think. In fact, often enough to make them unremarkable and - if you’ll pardon me the liberty - rather tedious.

Per the chart below (courtesy of JP Morgan) there have been 13 bear markets since the biggie in 1929. That’s a bear market every seven years or so.

Let’s shorten the timescale. Since 1980 there have been five bear markets. Despite this, since November 1980 the S&P500 has delivered an annual total return of 11.6%.

From the turn of this century, there have been three bears, and two of these were proper grizzlies (the bursting of the tech bubble in early 2000, and the Great Recession of 2007-9). Despite this, since March 2000 the S&P500 has delivered an annual total return of 7.1%. Do I need to tell you what your cash savings have delivered over the last couple of decades?

“Since the end of World War II, there’s been [a bear market] on an average of every five or six years. But on VJ Day, the S&P Index was about 15; look at it now. You couldn’t have timed the bear markets in between, and it turns out you didn’t need to.”

Over the last 90-odd years the average peak-to-trough bear market decline is 42% and it takes 22 months to get there. The FCA (our regulator) says you good folk don’t understand percentages, so let me spell it out: in a totally average bear market, your example £100,000 portfolio would temporarily decline to £58,000 in just shy of two years.

Although that seems a long time, two years is really the blink of an eye. I had Christmas dinners at my ex-in-law’s that seemed to last longer.

Whichever way you slice it, bear markets occur roughly every seven to eight years. Think about that in the context of a totally average three-decade retirement.

Mr and Mrs Retiree are likely going to have to weather four or so bear markets in that time. They are going to have to have the absolutely necessary fortitude and resolve to ride out these common-as-muck events.

If they can, all well and good (not guaranteed, one day the sun won’t rise in the East etc). If they can’t - and history proves that many, many can’t - they’re doomed.

you cannot get the permanent advance without the temporary declines. learn to love bear markets - they are the rational investor’s life-long sweetheart.

“Life is 10% what happens to you and 90% how you react to it.”

SUMMER PRACTICE UPDATE

“summertime, and the living is easy(er)”

Nick Lincoln, IFA and owner of V2VFP Ltd

The monumental date of 21st June is fast approaching. Apparently, this is when we will be allowed to do all most of the things we used to do without Nanny’s pre-approval, and for this, we must - must - be ready to go on bended knee and grovel in appreciation.

I withhold judgement: someone will only have to sneeze in Burnley and the whole thing will be put back another few months because “safety”. One thing is for sure: travelling abroad will remain a complete pain in the you-know-what for a considerable period, especially now the State realises it can endlessly play the “variant” theme to a supplicant, petrified populace.

Who knew an airborne virus could mutate? Wow. It’s almost as if there’s a reason there will never be a cure for the common cold. Nevermind….

In literally brighter news, the weather of late has been lovely and the recent half-term was especially blessed, at least early on. I hope that you managed to do something with your half-freedoms during this time. Certainly, there appears a good deal of pent-up entertaining and socialising going on. Let’s hope this is sufficient to kickstart what remains of our hospitality sector.

The Lovely Penelope’s (TLP) burgeoning flow-art skill set continues to be finely honed, with two steps forward and one back the general gist. Hey, if it was easy, everyone would do it, right? And where’s the fun in that? TLP is also in charge of the garden (I do the grunt work: that’s fine by me. Once a grunt, always a grunt) and the work she has done in it since we moved here in December 2018 is coming to fruition. She is especially proud of her rhododendrons (thank God for the spell checker!)

Work-wise, things are good. For no particular reason April, May and June see us carry out a lot of Annual Planning Meetings (APMs) with our clients/friends. This year more than ever has it has generally been a pleasure to do so:

All of the clients I have spoken with remain healthy and appear to have swerved the “pandemic”;

As a result of the inability to do pretty much anything involving expense bar gardening, clients have very healthy cash savings balances, helping to strengthen their financial plans; and

Investment valuations have soared over the last year or so, often to the surprise of the investors themselves. As ever, good news doesn’t sell. Or, “if it bleeds, it leads”. No news headline ever says “Billions wiped onto the stock market today.”

It was back in Autumn 2008 that I set up the company, with a view to providing full-fat financial planning to all new clients and to those existing clients who wanted it. Ups and downs along the way, for sure, but I’ve never regretted going out on my own. Values to Vision’s financial year-end is 30th June and the business has never been stronger in terms of turnover and - more importantly - gross profit.

For that, I thank you all. Few things in life are as emotionally charged as money, whether it’s been inherited, or blood-sweat-and-teared for (it’s frequently both, of course). And financial planners, like no other profession, get to sit with other human beings at the intersection of their dreams and aspirations and money. It’s always a ride and I’m always deeply appreciative of the trust you place in my helping steward you to financial independence on your terms.

As ever, thank you for your faith in our services over this period. Do you think your friends and family are being equally well served by their financial counsel? Please remember I am here to offer a no-obligation review of their financial plan and the investments fuelling it.

Onwards and upwards!

“Success is not the key to happiness. Happiness is the key to success.”

FEAR OF MISSING OUT STRIKES AGAIN

If it's not Bitcoin, It's Dogecoin, Or gold, or some other nonsense. ultimately, it’s all “f.o.m.o.”

FOMO strikes again. This never ends well….

The Tweet above was sent on 11th May 2021. I have no idea over what time period these “losses” were incurred. Just for context, the 12 months up to and including that date saw total returns for the UK market (FTSE-100) of 20%; for the US market (S&P500) of 46%; and for global markets en masse (MSCI World) of 42%. Source: FE Analytics.

To be clear: if on 12th May 2020 you’d eschewed both individual stock picking AND the lures of active fund management AND not betted on which next part of the world was the new “hot” growth spot, you could have picked up a 42% return in 12 months by whacking your cash into a tracker that just follows global stock markets. {NOT advice. Stuff goes up as well as down etc}

Note that nowhere in this highly complicated strategy do I mention “chasing momentum” as an integral tactic. Primarily because I have no idea what “chasing momentum” means. Nor, apparently, does the hopeless sap who set out to do it and is somehow nursing over US$150,000 of “losses” in his family portfolio.

Further, note that I am praying for his sake that his family is exceptionally tolerant and forgiving. If it’s family along the lines of, say, the Corleone clan, then our erstwhile “investor” may at this very minute be swimming with the fishes.

I mean: what is up with these loons? Why do people invest in stuff they don’t understand? Why are they foregoing the superb inflation-busting returns that The Great Companies of The World offer en masse to anyone who has the patience and fortitude to ride out their continual seesaw ride of temporary declines amongst the permanent advance?

When all is said and done, there are just two investor fears: one is the permanent loss of capital (by the way, this is almost impossible with a highly diversified portfolio and a good dose of Father Time). The other is more pernicious: Fear Of Missing Out - FOMO. And it’s FOMO that leads the loons over the edge, “chasing momentum”.

Another lemming looking for the “next big thing” to take his portfolio over the cliff edge.

FOMO on the next Tesla; FOMO on the next BitCoin / Dogecoin (God help us all); FOMO on the next Amazon; FOMO on some illusory “momentum”. Some might say FOMO is just greed. I withhold judgement.

But it takes a particularly peculiar mindset to construct a portfolio that loses over US$150,000 during a period when all markets everywhere have seen rising values. Most indices are at or near record highs. But nothing ignores these indicators like FOMO. FOMO says “but I can make more”.

I can almost guarantee that the subject of the Tweet has no financial plan to guide his gambling investing decisions. He is thus investing in a vacuum, with no context. Our mantra is and always will be “No plan then no portfolio, no exceptions”. A portfolio without a plan is a disaster waiting to happen. If you’re a financial adviser, it’s a complaint in waiting.

Investing in line and with - and only ever in servitude to - a financial plan is the antithesis of FOMO. In effect we say “based on your financial plan, here is the return you need to ensure you run out of life before you run out of capital. Here is the beautifully diversified portfolio chock full of The Great Companies of The World, a portfolio that - based on the last 120 years or so of empirical data - gives you and yours the best chance to fight off the corrosive effect that inflation will have over the next three decades or so on the purchasing power of your money. We believe that with all our fingers crossed and a willing heart, this portfolio will lead your family to financial salvation. Take it or leave it.”

During a random half-term moment of idleness, I examined our “100% Great Companies of The World” portfolio. Turn out this has over 9,000 individual stocks within it, spread all over the world. That, to my mind, is diversification.

At Values to Vision, we are the stewards of our clients’ hard-earned capital. We only ever invest in accordance with the requirements of a client’s financial plan. With our beautifully diversified portfolios, we don’t want to make a killing or to be killed.

FOMO is all about making a killing. More often than not, the investor (figuratively) is the one who gets killed.

“There are worse things in life than death. Have you ever spent an evening with an insurance salesman?”

INFLATION IS TO RETIREMENT WHAT CARBON MONOXIDE IS TO HEALTH

This is a recurring piece. Each quarter the figures will be appropriately updated. Why? because while the numbers will change around the edges, the message is eternal!

A typical retired couple may well see one partner live for three decades or more. Over such a long period, the annual cost of Lifestyle could more than triple. Says who? Says me: financial planning involves enormous ambiguity. If you want certainty, die now.

So an example Lifestyle cost of £50,000 per annum entering retirement could later escalate to £150,000 a year, just to keep standing still, to keep buying the exact same amount of “stuff”.

If you really must, some prosaic evidence: in 1991 a First Class stamp cost 24p. Today? 85p. See detailed graph below:

Some nuggets to lessen the gloom (past performance is no guarantee of future returns etc):

Three decades ago - Summer 1991- the S&P 500 (The Great Companies of The USA) was valued at 378;

Today, 30 years on - Summer 2021- The Great Companies of The USA are valued at c.4,200;

In three decades these Great Companies have grown in value by a factor of 11;

In addition, the dividends paid by these Great Companies have risen five-fold in those 30 years.

The last three decades have seen three severe "get me out of here I can't stand it anymore" bear markets (2001-3, 2007-9 and Q1 2020) and numerous smaller temporary declines.

Source for US market figures here. Why US data and not UK? Because the Yanks have this kind of thing publicly available and we don't - yet.

Dear Reader, the big risk to a dignified, independent retirement Lifestyle is the destruction of purchasing power via inflation. Like carbon monoxide you can't hear it, smell it, see it, taste it. Yet inflation will silently, stealthily kill your wealth.

The cure? Possessing a Financial Plan fueled by ownership of The Great Companies of The World: equities.

The problem with the cure? It's really really hard to stick with your Plan and stay invested through the horrendous-but-always-temporary-declines. The cure for the cure? Having a tough-loving, empathetic counsellor to stand between you and "the big mistake".

Having stated the problem, and maybe scared you witless, I hope the above figures give you a glimpse as to the only rational, moral solution for a healthy couple facing a three-decade plus retirement!

“Inflation: odourless, tasteless, and utterly poisonous to a dignified, independent retirement.”