What We Do

"Are We Going To Be OK?"

"Define It. Cost It. Fund It."

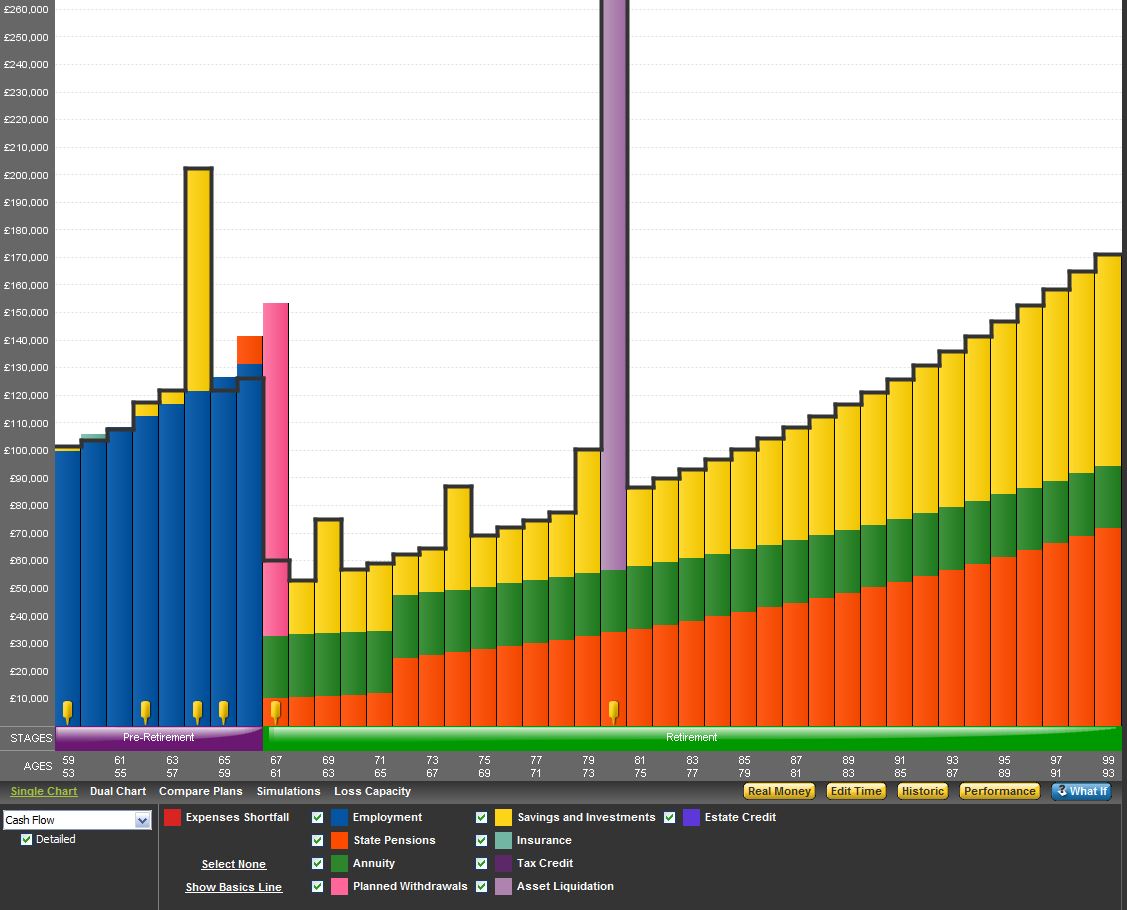

We help you obtain - and maintain - your Lifestyle without fear of ever running out of money. We show you whether or not you are going to be "OK". And if the answer is "No", we show you what you need to do, to get on track.

We call this Lifestyle Financial Planning and we deliver it in three distinct stages.

1 - "Define It"

Your Lifetime Financial Forecast: Bringing your Future into the Now, in order that we can do something about it

Firstly, we listen: you tell us your goals and aspirations, what you want the rest of your life to look like. So this is the really important stage; it is your chance to talk about the life you want to have.

2 - "Cost It"

Secondly, we together calculate the cost of your current and desired future Lifestyle, building in all your future goals and aspirations.

3 - "Fund It"

We match your current and future incomes and assets against your current and future Lifestyle costs. Clearly and directly, we will tell you what you need to be doing now in order that you do not run out of money later. This is your road-map to financial independence and peace of mind.