Welcome back, Dear Reader, to the latest quarterly missive from Nick Lincoln. This edition has SEVEN articles.

Prefer a print-friendly version or a PDF? Want to forward the Hat-Tip newsletter to someone you really don’t like? Click on the appropriate icons above.

"NICK, WHY DIDN'T YOU TELL ME TO DO THIS?"

THE DREADED INHERITANCE TAX (IHT): NASTY BUT MAYBE OVERBLOWN?

Few things agitate The Fading Fourth Estate Sunday Money Supplement hacks like Inheritance Tax (IHT). Likewise with well-known national “wealth managers” who hire swanky country piles to run seemingly endless “free” estate planning seminars the length and breadth of the UK.

The subject of IHT / estate planning is a “hardy perennial”, returning year after year, at different times of the year, with broadly the same colour scheme and mating calls.

Namely:

IHT is levied on the value of things one leaves behind for loved ones: it’s wrong that those loved ones have to pay this tax at a time of stress and grieving, and which can often only be settled via the forced selling of the deceased parent’s home;

IHT is a tax on assets that have been acquired from already taxed income, and on which various other taxes have been plundered (Stamp Duty, VAT etc).

If you use clever, fiddly-widdly expensive planning and related investments, you can mitigate the IHT bill your loved ones will have to pay.

There is some truth in these statements. However I do wonder if, after a decade of changes and uplifts to the IHT regime, we ought to revisit our perceptions of this unpopular tax. I might even go so far as to commit to paper this thought: “People should stop whingeing about IHT. It is really not a problem for the vast majority. Stop poking this bear. Let things lie.”

This thought was prompted by an actual client conversation (unlike Personal Finance journalists, I work with actual clients delivering actual financial advice. Novel, eh?)

Let’s call my client Mr Kenton. He phoned to me in mid-July to ask whether his accountant was right in saying that he could gift away £3,000 between his two adult children and could do so each and every year, and that these gifts would immediately fall outside of his estate for IHT purposes.

[By the way: apologies if this technical stuff makes you glaze over. Sometimes it cannot be avoided.]

I replied that, yes, his accountant was spot on in terms of her understanding of the tax rules (always a good place for an accountant to be). To which my client’s terse response was the headline quote above. My reply should have been: “As is often the case with accountants, yours has given you a beautiful solution to a problem you don’t have.”

“Inheritance tax is, broadly speaking, a voluntary levy paid by those who distrust their heirs more than they dislike the Inland Revenue.”

In reality my response was something along these lines (again, the glazing over of eyes is entirely understandable):

ME: “Your house is worth around £900,000 right? And you and your wife have ISAs and cash savings of about £300,000, and personal pension pots of around £650,000, correct? OK, good enough. So in total your estate is worth around £1,850,000.”

CLIENT: “Spot on. Gosh you’re good Nick.”

ME: “Nice try but you’ve got my gander up. Using your and Mrs K’s available IHT exemptions - including a relatively new one involving the family home - means the first £1M of your estate is not liable to IHT. And as I’ve told you before, your pension pots are outside of your estate. They are not liable to IHT.”

CLIENT: “Oh dear, I forgot about that. Please be gentle.”

ME: “No way, José. You brought your accountant into my life. You can sit and listen whilst I exorcise her the hell back out.

So you have (£1,850,000 - £1,000,000 - £650,000) £200,000 of your estate liable to IHT at 40%, were you and Mrs K to die tomorrow, right pally?”

CLIENT: “Part of me is wishing I was dead right now. Please stop.”

ME: “So the IHT your children would pay is £80,000, as this is 40% of £200,000. Agreed?”

CLIENT: [muffled sound, sounds like crying. We’ll interpret this as a “yes”.]

ME: “So your children will inherit £1,850,000 and pay IHT of £80,000 for the pleasure. In other words, just a smidge over 4% of the value of your entire estate. And the cash and ISA savings will naturally be depleted over time, as per your financial plan, as you draw on them to fund Lifestyle costs, so reducing the IHT bill further. It may be that your heirs will pay no IHT when Mum and Dad have popped it.

Can you perhaps see why I ‘didn’t tell you to do this’?’ ”

CLIENT: “I need an Aspirin.” [Phone line goes dead]

Some of the above has been adapted, and the figures changed to make the strongest point, but that was the gist. Whisper it but I don’t see IHT as an issue for that amorphous blob known as Middle England (my England, by the way).

Simply put: not many estates pay IHT, and IHT as a tax is a stunted runt. For the whole UK it brought in £5.4BN to Supreme Chancellor Sunak’s goon squad in 2018-19. By way of comparison, in that same fiscal year, our overlords spent £10.8BN a month - A MONTH - on NHS England alone, in order that we could maintain a health system that was totally not willing to receive patients come a supposed pandemic a year or so later.

Note:

This is based on current legislation. Supreme Chancellor Sunak has been hosing money at an economy that his Government has put into a coma. Someone’s got to pay for that, and that someone is people just like you and me. Am I categorically stating there will be future tax rises? God Lord no. Just don’t expect IHT legislation to be relaxed further any time soon.

In fact, there’s a current review of the whole IHT landscape buried somewhere deep in Whitehall, pending the resolution of That Wuhan Thing. No cloud without a silver lining and all that.

Furthermore your IHT situation will be different, and the exemptions quoted change from estate to estate, depending on the size of your estate, to whom you are leaving your family home (yes, really), the position of Saturn relative to Uranus etc.

Sunday money supplement sections and “free” seminars from wealth managers on I.H.T and estate planning are solutions crying out for a problem. the end.

“By the way - also appreciated your steely resolve at the COVID crash! Other advisors melted down. ”

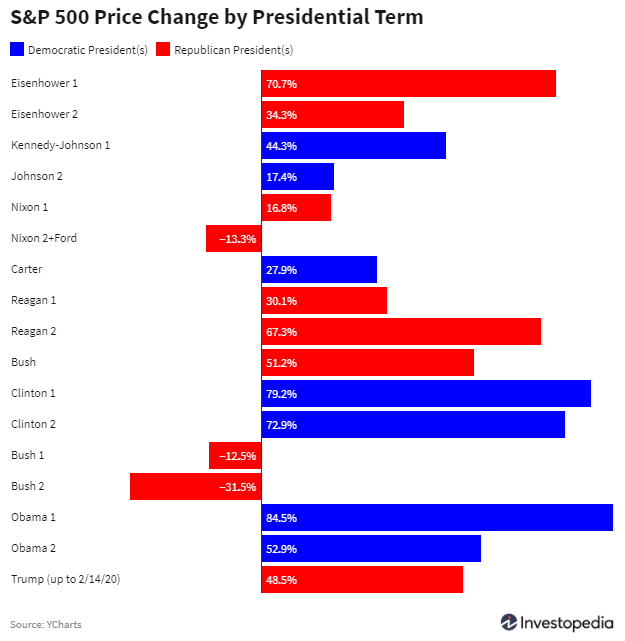

MARKETS DON'T CARE WHO'S IN CHARGE

Be it Biden or Trump, over the long-term, it will make no difference (probably)

Here we are, thousands of miles away, yet the impending US Presidential election will surely dominate our headlines over the coming two months or so. I tire of the whole thing within a week. Pity the poor Americans who have to suffer this nonsense for the duration and really cannot escape from it.

It seems a Hobson’s choice: one candidate sadly is losing control of his faculties in front of our eyes; struggles with detail; often seems lost and bewildered; has his entourage of handlers petrified every time he goes in front of the camera.

And the other is Joe Biden.

Anyway, that’s their problem. Our problem (you and I, Dear Reader), supposedly, is trying to make sense of the result in terms of how it affects investment policy. At least, that is what 99% of the personal finance world (advisers, “consultants” to advisers, and assorted media types) will be trying to do.

Their reasoning (I’m being generous) goes something like this: “This is a seismic event. We don’t know if Biden or Trump will win. We have absolutely no control over the outcome. In all honesty, we have no clue as to how markets will react to either eventuality. Despite this, on the back of these short-term unknowable uncontrollables, we are going to change the investment policy that underpins your long-term financial plan. We recommend immediatley shorting the US via the ‘Whizzbang Incomprehensible Absolute Return Fund’ and putting the rest of your portfolio into pork bellies. We’ll come back to you with our next ̶g̶u̶e̶s̶s̶w̶o̶r̶k̶ idea involving your money in early December. Thank you and here’s the bill.”

Back here on Planet Earth, we don’t do that. We do not countenance changing investment policy in the coming weeks. Down that path lies madness (and, more importantly, financial ruination).

Looking at the runes it’s clear enough that in terms of the values of The Great Companies of the USA it doesn’t really matter who is in charge over the water (see below).

Source: https://www.investopedia.com/presidents-and-their-impact-on-the-stock-market-4587369

And what if Joe Biden wins? Aside from CV19 magically disappearing from the 24/7 newsfeed (guaranteed) what else can we bank on? Who knows. But on one thing I feel assured (my arrogance is founded in owning a useless BA in American Studies with Politics).

Namely: no matter how many Guardian column inches are given over to vacuous cretins like Alexandria Ocasio-Cortez, it seems unlikely that her brand of socialism will take hold in the foreseeable future, even if Uncle Joe wins in November and is in a padded cell by December.

Never forget:

Americans don’t do socialism.

Twitter is not America.

No-one reads The Guardian (except 102% of people at the BBC).

So - in terms of your financial plan - try and tune the forthcoming US jamboree out. It won’t be easy. The day after the election will probably see markets move sharply. The two-fold problem in that statement of the bleedin’ obvious is firstly that pesky qualifier word “may” and, secondly, we have no clue if the sharp movement is going to be north or south.

I invest my family's wealth in exactly the same way I invest yours. I use the same funds, the same principles. I take my own medicine. And I’m not changing my medication based on what may or may not happen in November.

today’s prescription (and yesterday’s and tomorrow’s) remains: “No change to your long-term financial plan? Then no change to your long-term investment policy.”

PS - my hunch is that Trump is re-elected. You heard it here first.

“If you think health care is expensive now, wait until you see what it costs when it’s free!”

AUTUMN PRACTICE UPDATE

thank heaven for tech (with caveats)

Nick Lincoln, IFA and owner of V2VFP Ltd

I hope your summer holidays were enjoyable, and for those of you who were working through That Wuhan Thing, that you had a chance to recharge your batteries. For those of you furloughed throughout this whole mess I can only imagine that the whole year to date has pretty much been one long summer holiday…..

The Lovely Penelope (TLP) and I did not venture to foreign shores: it just seemed like too much hassle this year. Instead we stayed on this beautiful island; went walking on the fab Pembrokeshire coast; and generally did our utmost to revive the UK hospitality sector (as defined by pubs and restaurants).

Clichéd image representing the season.

From the practice point of view, my diary in the summer is deliberately engineered to have little client facing work in it. TLP is a headteacher - at an Ofsted rated outstanding school (have I mentioned that before?!) - and so the six weeks we have together are important to us.

By that I mean it’s important to her that I get out from under her feet and away from the house as much as possible.

So it is that I have played a fair bit of tennis and cricket recently. TLP has been at home, pottering about the garden (the real love of her life), and wondering just how many children / young adults / stakeholders she will have at school when the new academic year begins.

The client interactions I did have through the summer months were done over Zoom, as they have been since February, for obvious reasons. Thankfully I have been using Zoom for a couple of years now with certain clients, so I was ready to hit the ground running when it became de rigueur earlier this year.

And yes, the novelty of using video conferencing software soon wore off, didn’t it? It is fatiguing to use, especially so when you are hosting a meeting with various attendees.

Typical Zoom meeting. Half the attendees are looking at their WhatsApp messages and the rest are trying to keep their eyes open.

But thank the Lord we have the tech to enable us to communicate in this way. Just a decade or so (with dial-up modems etc) it would have been a nightmare. 20 years ago it would have been unimaginable. For our older citizens - quarantined in their own homes for weeks with no human interaction - Zoom and its ilk must be a godsend.

Will we be using Zoom extensively going forward? No. But it will be used more by us, with more clients, and this has to be the case with service professions across the spectrum. As ever, the limit on the tech is not the tech itself but our imagination in best using it.

Having said that, as I type this it looks like non-physical client meetings are here to stay through the rest of 2020 anyway, so in the short-term the Zoom / not-to-Zoom debate is moot.

In other news my company’s year end is 30th June. The last business year saw turnover at a new high since formation in late 2008. I would like to thank all of my clients for your continuing faith in my services. It truly is a pleasure to serve you as best I can. Rest assured that, should you refer me to your friends and family, I will seek to serve them to the same standards.

Wishing you and yours a happy and healthy Autumn 2020.

“Nobody planned the global capitalist system, nobody runs it, and nobody really comprehends it. This particularly offends intellectuals, for capitalism renders them redundant. It gets on perfectly well without them.”

OVER 65s AT GREATER RISK

no, not from “that wuhan thing”. I’m talking about “the big mistake”

Sometimes I get push back (mainly from other advisers) around the notion that the greatest value I add to clients is getting them to stick to their financial plan when the entire Universe - reacting to the latest Catastrophe-of-Catastrophes - is screaming “Don’t just stand there. DO SOMETHING!”

“People aren’t dumb,” say the sceptics. “Most people won’t sell out of their portfolios when the shinola next hits the fan. This behavioural counselling nonsense you spout is hogwash. Why don’t you talk to clients about what really matters? Stuff like fund performance, economic forecasts, market prognostications, the weather and all that jazz.”

And then the shinola does hit the fan. And what happens next? Otherwise sentient, rational adults turn 100% dumb.

Such was the insight I gleaned from an article in the American online publication Financial Advisor (sic).

Per the article, according to Fidelity Investments “nearly one-third of investors above 65 sold all of their stocks sometime between February and May.” Now, I’ve read the article a few times and I still can’t work out whether that’s investors with Fidelity, or all US investors en masse, or investors who invested with Fidelity via LPL (a massive American advisory / investment broker).

However you interpret it, it’s an absolute zinger example of how people do react to events (as opposed to how they should react.) Yet again, homo economicus - rationale, capable of thinking through all possible outcomes and choosing that course of action which will result in the best possible result. - exists only in the “Dismal Science” of economic theory.

Let us visualise Mr and Mrs Retired Couple (each aged 65) who saw their portfolios fall double-quick time in value in February-March by 30%. Rather than see this as:

“Incredibly, we saw nearly a third of all investors over 65 years old sell their full equity holdings,

With stocks now back near highs, this is yet another reason to have a plan in place before trouble comes, as making decisions when under duress can lead to the exact wrong decision.”

nothing more than a temporary decline;

perfectly to be expected after a raging decade-long bull market;

absolutely something one should expect every six years or so

the hopeless saps were overwhelmed, threw up their hands and said in effect “get me out of here. We can’t take it anymore” and bailed out of their portfolios. In so doing they turned a paper loss into a real one. Worse still, they then missed out on the very quick and strong recovery in the share prices of The Great Companies of The World.

Worse even than that (!), Mr and Mrs Retired Couple have spent every waking moment since they bailed out wondering when (and if) they should bail back in. That’s not my idea of a dignified, independent retirement. That’s my idea of living hell.

Yes, Dear Reader, our hapless couple have been practising the mystical Oriental art known as “市场时机” (“Market Timing”). Like countless failed investors before them, Mr and Mrs Retired Couple are waking up to the consequences of dabbling in the black arts.

To wit: there are two-spells you must cast to win at Market Timing: you must firstly guess the exact right time to leave the markets and then, secondly, do likewise when you decide to go back in. Sounds impossible to successfully cast both these spells? That’s because it is.

This, Dear Reader, is The Big Mistake writ large. Making it could well have derailed the retirements of goodness knows how many retirees.

And all of the while, the proceeds from these liquidated portfolios are sitting in deposit accounts, earning three-fifths-of-bugger-all before tax. Cash which is seeing its real value (purchasing power) day by day eaten steadily away by the insidious destroyer of wealth: inflation.

All that stands between people and The Big Mistake is an independent counsellor. Someone who tells these understandably nervous retirees “don’t just do something. Stand there.” Easy to say, hard to practice. Remember, it’s OK to be nervous during times of market stress and seemingly end-of-times bad news. It’s not OK to act on those nerves.

Put another way: “..making decisions when under duress can lead to the exact wrong decision.”

None of my clients bailed out in February / March, and I sincerely hope that (if you are not a client, Dear Reader) you didn’t either.

Mr detrick’s closing paragraph above is the front-runner in the “2020 understatement of the year” contest.

SLAYING THE THREE-HEADED MONSTER!

the cerberus that is k.p.r: kuenssberg - peston - rigby

In the last Newsletter (Summer 2020) the lead article focused on the absolute state of the legacy media. Namely, its coverage of That Wuhan Thing (ongoing and seemingly never ending - got your mask yet?) and the associated plunge-off-a-cliff bear market in February and March.

So, as an antidote to the Cerberus♰ that is KPR I give you this, Dear Reader. Enjoy. If you’ve seen it before, watch it again. And if you know anybody who is addicted to 24/7 news channels and the evil they represent, why not fire this across their bows? They may be for saving yet.

Contains an F-bomb at 1m35s.

♰ In Greek mythology Cerberus is a three-headed dog that guards the gates of the Underworld to prevent the dead from leaving. KPR is its modern equivalent, tasked with keeping the “news” permanently negative to prevent positivity from arriving.

“We have our own dream and our own task. We are with Europe, but not of it. We are linked but not combined. We are interested and associated but not absorbed.”

WOT I'VE BEEN CONSUMING

a regular section in which nick pretends to have a sliver of cultural depth.

The last quarter of 2001 seems a lifetime ago. The atrocities of 11th September are forever scorched on our collective psyches. We are still grappling with the ramifications; our certainties (such as they ever were) about the primacy of the West and The Enlightenment severely challenged.

Against such a murderous act it seems almost banal to remember the Enron scandal, which unfurled around the same time as the toppling of the Twin Towers.

But placed in the corporate context alone, Enron was and remains a huge story nearly 20 years on. Brian Cruver’s breathless book “Enron: Anatomy of Greed” is a reminder of just how big and fast the fall of the energy giant was.

As a recent MBA graduate, 30 year-old Cruver joined Enron in March 2001, just a few months from disaster.

He is immersed from day one in the cult-like environment that dominated the lives of the company’s employees.

To challenge the orthodoxy was to lose one’s job. So Cruver got his head down and drank the Kool Aid, as they say in Texas.

Unfortunately for the author, Enron began to unravel shortly after his starting there. It was an empire (the head office in Houston was labelled “The Death Star” by both employees and competition) built on false accountancy and misrepresentation.

“Off balance sheet special purpose entities” - and lots of them - is the technical term. Thankfully Cruver explains these adroitly. You don’t need to be an accountant (God forbid) to get the gist of the con.

These “entities” existed to falsely boost Enron’s earnings. Lazy investment analysts and auditors didn’t dig deep enough, if at all. And boosting earnings was important, as the world and his wife seemed to own company stock.

Enron employees were awarded Enron stock as part of their remuneration. They would also trade in and out of Enron with their own money. Worse, many Enron employees had their 401k (pension) plans stuffed full of…. Enron stock. Diversification? Fuggedaboutit. This wasn’t investing, this was speculating. And these poor saps were on the wrong end of the deal.

People were wiped out. They lost everything, including their jobs. In hindsight it was madness but - with money - human irrationality trumps reason more often than not.

An enjoyable romp about a culture rotten from the top-down. Ken Lay, Jeff Skilling, Andrew Fastow - names evocative of the robber barons of an earlier era. This book describes it all clearly and at a good lick - highly recommended.

INFLATION IS TO RETIREMENT WHAT CARBON MONOXIDE IS TO HEALTH

This is a recurring piece. Each quarter the figures will be appropriately updated. Why? because while the numbers will change around the edges, the message is eternal!

A typical retired couple may well see one partner live for three decades or more. Over such a long period, the annual cost of Lifestyle could more than triple. Says who? Says me: financial planning involves enormous ambiguity. If you want certainty, die now.

So an example Lifestyle cost of £50,000 per annum entering retirement could later escalate to £150,000 a year, just to keep standing still, to keep buying the exact same amount of “stuff”.

If you really must, some prosaic evidence: in 1990 a First Class stamp cost 22p. Today? 76p. See detailed graph below:

Some nuggets to lessen the gloom (past performance is no guarantee of future returns etc):

Three decades ago - Autumn 1990 - the S&P 500 (The Great Companies of The USA) was valued at 315;

Today, 30 years on - Autumn 2020 - The Great Companies of The USA are valued at c.3,300;

In three decades these Great Companies have grown in value by a factor of 11;

In addition, the dividends paid by these Great Companies have risen five-fold in those 30 years.

The last three decades have seen three severe "get me out of here I can't stand it anymore" bear markets (2001-3, 2007-9 and Q1 2020) and numerous smaller temporary declines.

Source for US market figures here. Why US data and not UK? Because the Yanks have this kind of thing publicly available and we don't - yet.

Dear Reader, the big risk to a dignified, independent retirement Lifestyle is the destruction of purchasing power via inflation. Like carbon monoxide you can't hear it, smell it, see it, taste it. Yet inflation will silently, stealthily kill your wealth.

The cure? Possessing a Financial Plan fueled by ownership of The Great Companies of The World: equities.

The problem with the cure? It's really really hard to stick with your Plan and stay invested through the horrendous-but-always-temporary-declines. The cure for the cure? Having a tough-loving, empathetic counsellor to stand between you and "the big mistake".

Having stated the problem, and maybe scared you witless, I hope the above figures give you a glimpse as to the only rational, moral solution for a healthy couple facing a three-decade plus retirement!

“Inflation: odourless, tasteless, and utterly poisonous to a dignified, independent retirement.”